ramp up their marketing efforts and invest in growth.

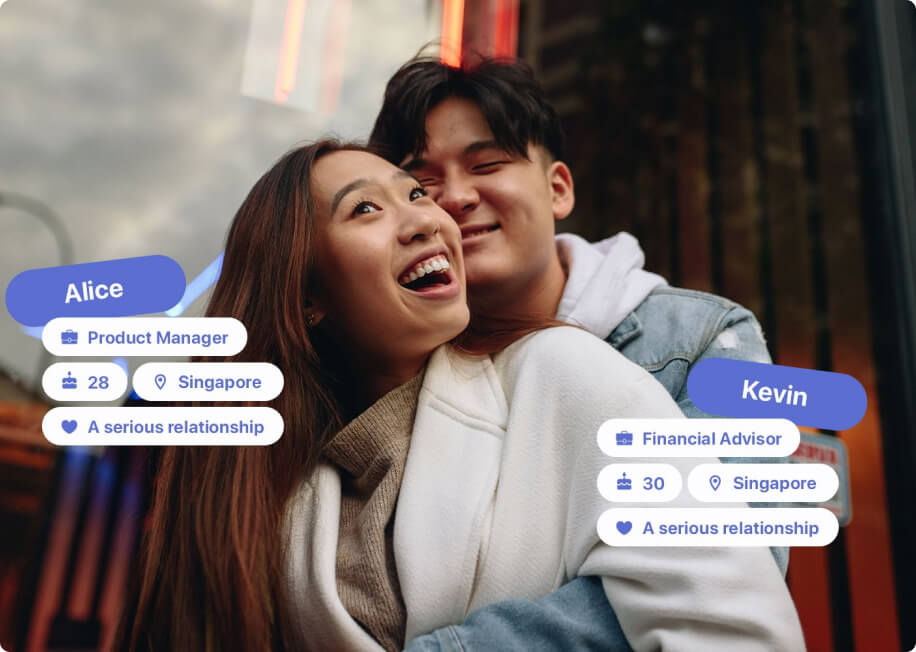

Coffee Meets Bagel (CMB) is the well-known “anti-swipe” dating app, where over 90% of users are looking for serious relationships. Since its launch in 2012, CMB has made over 150 million matches, thanks to its personalized algorithm and established brand catering to more serious daters.

Though it is one of the most popular dating apps in North America, CMB has become the fourth highest grossing dating app in Southeast Asia, where the company’s mostly organic growth and word of mouth marketing have driven adoption. After appearing on Shark Tank in 2015, and famously turning down a $30 million offer from Mark Cuban, CMB went on to raise over $20M in funding, and grew to over 50 employees.

On the heels of CMB’s Series B financing round in 2018, Quincy Yang joined as the company’s CFO, bringing with him over 15 years of financial and operational experience in high-growth organizations. But no one could have anticipated the COVID-19 pandemic and the ensuing challenges that the entire dating industry would experience just two years later. “By virtue of COVID-19 changing how people work and interact, people were less likely to have serendipitous conversations such as which dating apps you’re using and about your dating life generally,” Quincy explains. “Across the industry, natural organic word of mouth declined, but it’s not like the need for dating went away.”

Coffee Meets Bagel has made over 150 million matches and is the fourth highest grossing dating app in Southeast Asia.

Faced with heightened pressure from competition and changes in user behavior, CMB knew they would need to double down on their marketing efforts, and that they would need additional capital to do it. Quincy began exploring options including venture debt and revenue-based financing (RBF) ultimately deciding to accept an offer from a well-known RBF provider. Unfortunately, it wasn’t as straightforward a path as they had hoped: after a year of working with this partner, they suddenly changed their lending model and discontinued providing the funding that had previously been committed. Quincy knew they needed to find another option quickly, but he also wanted to be extremely diligent about their selection in light of this experience.

While Coffee Meets Bagel has a long history in the dating app market and sizable revenue, venture debt lenders struggled to understand their business model and growth trajectory, or they had narrow funding criteria. “I spoke to probably 15 different funding partners of all types, to see what would fit our company and our situation the best,” Quincy says.

“We were fortunate to come across Braavo. They designed a solution which was similar to venture debt, but uniquely customized for our business model given their familiarity with B2C subscription apps. For us, we needed the flexibility that Braavo brought, the speed at which Braavo was moving, and the clarity of the terms. Furthermore, the terms that Braavo offered were very favorable relative to other prospective partners.”

We were fortunate to come across Braavo. They designed a solution which was similar to venture debt, but uniquely customized for our business model given their familiarity with B2C subscription apps.

Since partnering with Braavo, Coffee Meets Bagel has achieved profitability. “We have very strong financial discipline, so we were able to get to EBITDA profitability pretty quickly, which aligned well with Braavo. Good business model, good product market fit, good financial discipline, that’s a good combination for considering a funding product like Braavo.” With the capital from Braavo, CMB was able to continue its marketing investment and significantly increase new user registrations in 2022.

By teaming up with Braavo, Coffee Meets Bagel has remained a category leader among the competitive dating app market, and is another example of how non-dilutive funding from Braavo powers some of the world’s most well-known subscription app businesses.

We were able to get to EBITDA profitability pretty quickly. Good business model, good product market fit, good financial discipline, that’s a good combination for considering a funding product like Braavo.